We’re Here To Help Female Founders Take The Next Steps Toward Success

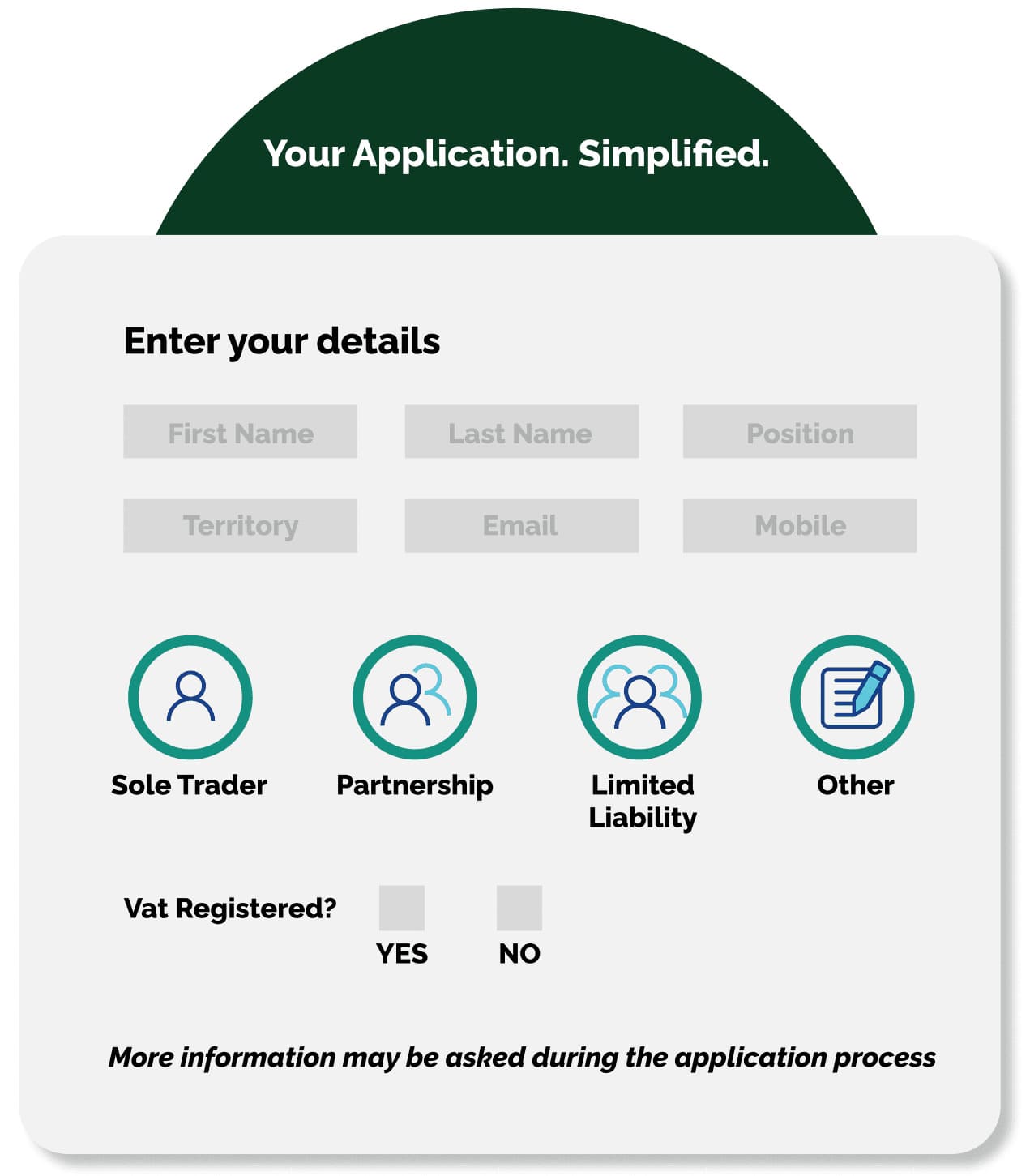

Discover Your Financial Fit. Take the quiz to determine which Inspire product can help fuel your business, whatever its stage.

We’re Here To Help Female Founders Take The Next Steps Toward Success

Discover Your Financial Fit. Take the quiz to determine which Inspire product can help fuel your business, whatever its stage.