Custom Financing

Unlock The Full Potential Of Your Business with InspirePlus. Scale For Sale Or Scale To Grow With Tailored Financing To Suit Your Needs.

Borrow up to US$250,000 (or local currency equivalent) for up to five years.

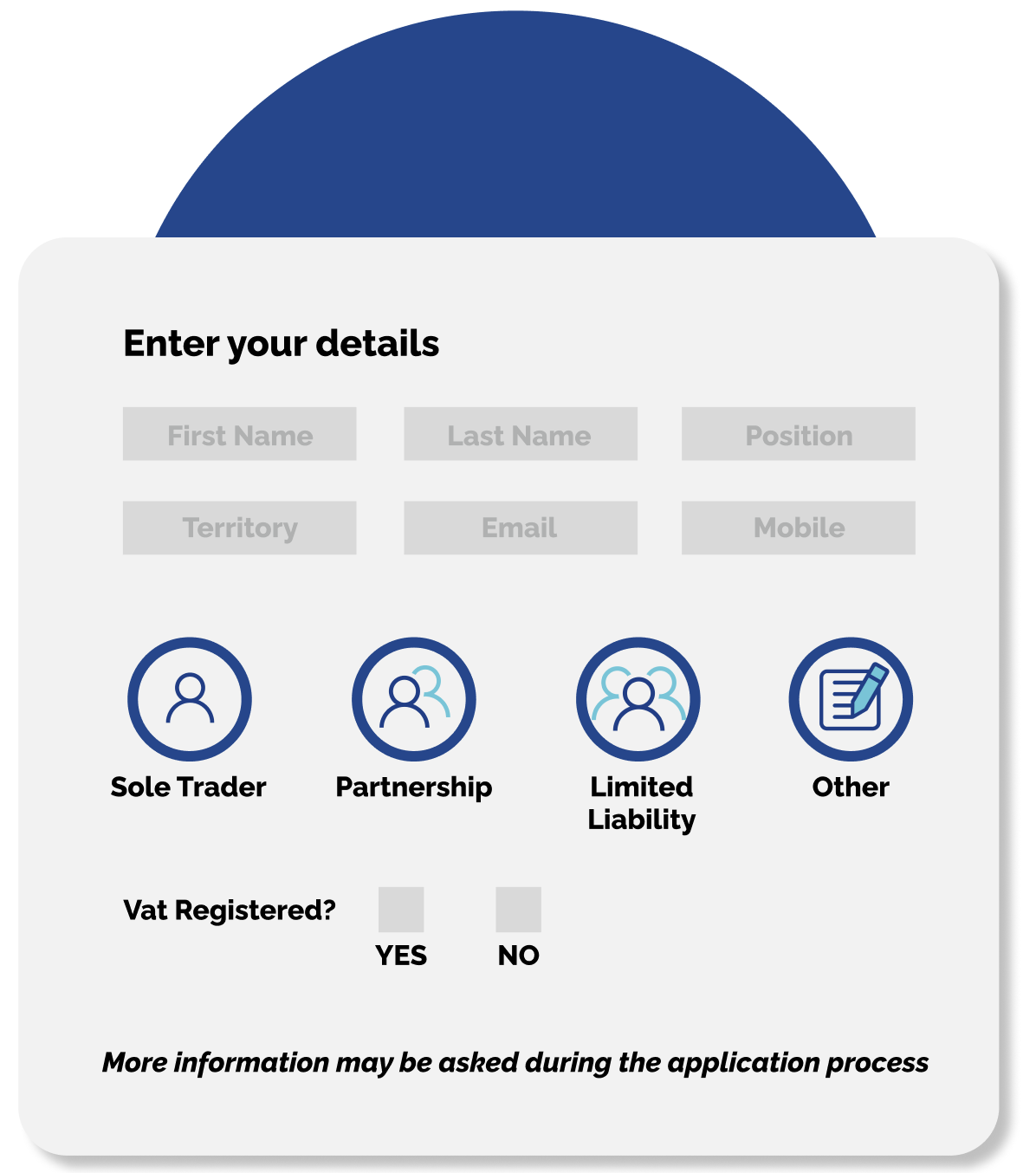

Seamless Application Process

Strategic Support

On A Mission To Fund 10,000 MSME Transactions by 2030

INSPI - her STORY

Getting the respect and funding from the bank was hard. I had to put in more work than what was needed. I self-funded my business for years until I got investors. I’m now a success story ready to expand into different markets but no woman should have to go through what I did. I know I am one of many.

Getting the respect and funding from the bank was hard. I had to put in more work than what was needed. I self-funded my business for years until I got investors. I’m now a success story ready to expand into different markets but no woman should have to go through what I did. I know I am one of many.

I’m glad Inspire exists and that they're willing to see me, and others like

me, as true drivers of the economy.

I’m glad Inspire exists and that they're willing to see me, and others like me, as true drivers of the economy.

- Hesma Tyson

CEO, Caribbean Food Delights

You Need Financing Tailored

Specifically For Your Business.

You Need Financing Tailored Specifically For Your Business.

We’re Here For You

1

15 Minutes

That’s all you need to start your

application. Upload your documents,

you’ll be contacted about your next steps.

2

One-On-One

From your application to our decision,

you’ll always feel supported by one of our business advisors.

3

Zero

The number of hidden fees to service

your loan.

InspirePlus, our custom financing solution, is designed to cater to the uniqueness of your business. As a client, you’ll have access to a range of tailored financial tools, flexible solutions and a supportive team to provide ongoing guidance every step of the way. You’ll also benefit from our network of professionals who can take your business in the direction you’ve yearned for.

InspirePlus, our custom financing solution, is designed to cater to the uniqueness of your business. As a client, you’ll have access to a range of tailored financial tools, flexible solutions and a supportive team to provide ongoing guidance every step of the way. You’ll also benefit from our network of professionals who can take your business in the direction you’ve yearned for.

Frequently Asked Questions

Here are some of your most commonly asked questions.

We offer revenue-based financing in which the amount you repay will be capped and predetermined.

Revenue based financing is tailored to you and flexible enough to grow as you do, For instance, repayment can be linked to your sales cycle, meaning you pay less when sales are low, and a higher amount when you have a bumper week.

Instead of using a regular interest rate we use “repayment cap.” Think of it as the total amount you’ll pay back on the financing, or the set “maximum” you agree to repay.

A business plan is essential for several reasons. Firstly, it provides a comprehensive overview of your business, capturing both its current financial standing and future potential. By laying out how you intend to utilize the requested funds, the plan offers a clear roadmap of the intended growth strategies and their expected impact on your business. We’ll review these figures and projections in relation to industry benchmarks and discuss them in-depth with you to ensure a mutual understanding and realistic expectations.

Learn more about our funding HERE.

More Questions? Ask Us

More Questions?

Ask Us